Luxury watches have always been more than tools for telling time. Experts suggest that certain models from brands like Rolex and Patek Philippe retain or increase in value over time. Collectors often view them as tangible assets, blending fashion with finance. Many athletes see watches as personal milestones that signify career achievements. Athletes’ affinity for high-end watches drives trends and demand. When a sports star is spotted wearing a rare timepiece, it often triggers a surge in interest.

Brand Power and Market Value

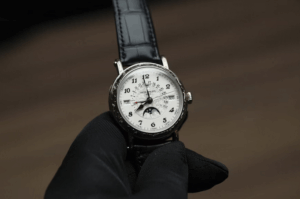

Luxury watches carry brand prestige that directly affects their investment potential, and SPORT.de highlights how athletes use these statement pieces to project status and sophistication while sometimes boosting their net worth. Rolex, Audemars Piguet, and Omega dominate the secondary market due to enduring desirability. A report by Forbes shows some limited-edition watches appreciate up to 30% in five years. These brands cultivate long-term trust, which gives buyers confidence in their financial potential. Scarcity adds to their value. Sports stars often acquire exclusive models, which boosts desirability among collectors. This phenomenon creates a secondary market where prices can surpass retail. Limited editions often become conversation starters and status symbols in professional circles.

Limited Editions and Rarity Factor

Limited-edition timepieces can act like miniature portfolios. Their rarity attracts collectors and sometimes guarantees long-term value. According to Financial Times, watches tied to iconic events or athletes often see a 20–50% value increase over a decade. Rare pieces also carry historical significance, making them appealing beyond pure aesthetics. Rarity isn’t just about numbers; it’s about storytelling. Watches associated with major tournaments or milestones hold emotional appeal. This narrative amplifies their investment allure. Buyers often pay a premium for the connection to memorable sports moments.

Limited-edition timepieces can act like miniature portfolios. Their rarity attracts collectors and sometimes guarantees long-term value. According to Financial Times, watches tied to iconic events or athletes often see a 20–50% value increase over a decade. Rare pieces also carry historical significance, making them appealing beyond pure aesthetics. Rarity isn’t just about numbers; it’s about storytelling. Watches associated with major tournaments or milestones hold emotional appeal. This narrative amplifies their investment allure. Buyers often pay a premium for the connection to memorable sports moments.

Maintenance and Authenticity

Owning a luxury watch isn’t just about buying; it’s about preserving. Regular servicing keeps mechanics precise and maintains resale value. Experts suggest keeping original boxes, papers, and purchase receipts for authenticity verification. A poorly maintained watch can lose both function and collector appeal very quickly. Authenticity is non-negotiable in luxury watch investments. Counterfeit or modified watches lose both aesthetic and market value. A well-documented, serviced piece retains appeal across collectors. Investing in professional appraisals can further secure a watch’s market worth.

Athlete Influence and Trend Cycles

Athletes serve as trendsetters, shaping which watches gain hype. When a star athlete wears a specific model, sales and interest often spike overnight. Market analysis indicates that athlete endorsements indirectly drive value in the secondary market. This effect can last for years as the watch becomes iconic within sports culture. Social media amplifies this effect. Photos of watches on the wrist of influential sports figures create viral attention. Limited availability coupled with hype can transform a watch into a coveted collector’s item. Followers often mimic athletes’ choices, driving both brand loyalty and investment interest.

Even with the right brand and athlete influence, timing is crucial. Buying during hype can be risky, while purchasing under the radar often yields better returns. Market cycles for watches often mirror those of stocks, with peaks and dips. Savvy collectors watch auctions, sports events, and brand releases to optimize value. Luxury watches are where style meets strategy. Observing sports stars, analyzing brand prestige, and valuing rarity help buyers gauge potential returns. Pairing aesthetic appeal with careful market insight makes a luxury watch not just a statement, but potentially a smart investment.